Energy Star Appliance Tax Credit

What is it & how do I get mine?

Are you wondering if you’re eligible for the Energy Star Appliance Tax Credit? Buying a new refrigerator is never cheap so getting a tax credit sounds terrific!

That’s why we created this page to ensure you get every dime you deserve for your refrigerator purchase (and possibly other purchases you already made!)

The Energy Star Tax Credit is super exciting to talk about because it was part of the Inflation Reduction Act of 2022, which was recently passed and extends to many different ways you can get paid for your purchase and lasts until 2032!!

So let’s get right down to the facts so that you understand how to get your Energy Star Appliance Tax Credit and get the monies owed to you.

(If you're ready to start looking at the refrigerator models available, then just click here to go to our Energy Star Fridge Reviews page. Here you will find dozens of Energy Star rated refrigerators to choose from.)

What is the Energy Star Appliance Tax Credit

The program is one of the many different residential tax credits offered through the Inflation Reduction Act of 2022.

As the name suggests, it is a tax credit that covers the purchase of appliances that are Energy Star Rated (or energy saving).

The goal

of this entire residential initiative is to impact our use of energy at

home called Residential Energy Efficiency.

This act was focused around the importance of decreasing energy consumption for both residential as well as commercial use.

(I love that the

government put this into place! It’s all a part of us trying to

align with the Paris Climate Accords of 2015. We all know to hit those

numbers, we ALL HAVE TO MAKE CHANGE, and how amazing is it that the

government is making it financially worth our while?!?!)

In case you're wondering, the other programs included in this ground breaking Act cover:

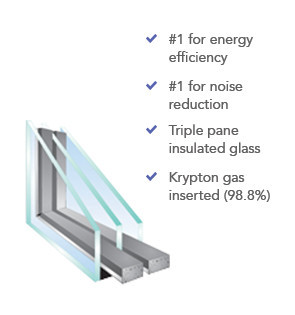

1. Energy Efficient Window Replacement: Older, single paned windows have many issues from difficulty in keeping temperatures consistent to a lack of noise reduction.

Adding triple-pained windows can make a huge difference in both your electric bill and keep the outside noises from coming in!

2. AC & Heat replacement: Replacing older air conditioning units with new ones will eliminate the

use the ozone depleting chemical of Freon.

Changing out more energy efficient heaters will not only offer a savings but will allow you to switch from gas to electricity which can have a huge effect on greenhouse gases.

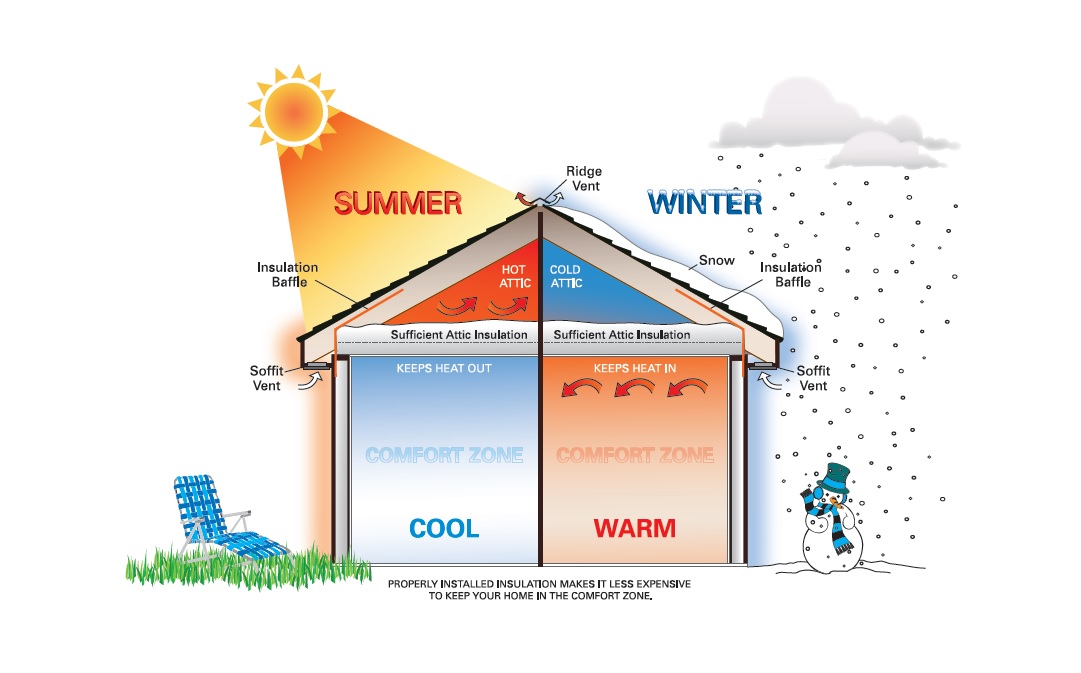

3. Home Insulation: Insulation has gotten so much better at keeping outside temperatures outside in the last 20 years.

The better the insulation, the easier it is to keep consistent temperatures in your home, using less energy and saving you money!

4. Alternative Energy Sources: This is a new way for all of us to help shift the situation we are all in by making the energy we use! These include ways to harness energy with fuel cells, small wind turbines, geothermal heat pumps, solar & wind.

(If you want

to be part of the solution Click here to be added to our Alternative

Energy Sources newsletter to learn more about what it is and the

programs out there that will pay you to implement them.)

Who is offering Energy Star Appliance Tax Credit?

These Tax Credits have been created by the EPA and the Department of Energy to help the transition away from less energy-efficient appliances. It makes this shift more accessible for all and helps decrease costs.

How do I get paid from the Energy Star Appliance Tax Credit?

It is what it sounds like, a federal tax credit that you get to take off of your taxes. The amount you can deduct from your taxes is 10% of the cost of your appliances, up to $500.

Here's the form you will need to fill out to receive the Energy Efficiency Residential Tax Credit.

If you're not sure how to do this all you have to do is let the person who does your taxes know so that they can add it as one of your deductions for the year

**That’s just the savings available to you on the federal level. Though there are still rebates, personal tax credits, and loans that might be available to you locally!

Click here to see ways you can save by buying your Energy Star Appliances in your local/regional area.

Why is the Energy Star Tax Credit being offered?

The main reason is to keep us on track to hit the markers set by the Paris Climate Accord to hinder global Warming. The United States primarily depends on fossil fuels as an energy source, and to hit the goals laid out for us, we will all need to shift to electricity ASAP.

The goal with all of the federal energy efficiency tax credits (which could save you upwards of $14,000 in rebates across your home) is to find individual ways each of us can make an impact on reducing greenhouse gas emissions.

The US government wants to decrease our energy usage 40% by 2050. While this number sounds impressive, the goal set by the Paris Climate Accords was 50% to stave off global warming.

(Shaving off an extra 10% off of our energy usage (above and beyond these incentives) would benefit us all.)

The government is hoping that the tax credit will cause most households to make the changeover at a faster rate, allowing us to reduce the amount of energy we are all using at a faster rate.

Where do I have to live to be eligible for the Energy Star appliance tax credit?

The Energy Star Appliance Tax Credit we are referring to is only available to people living in one of the 50 United States of America.

Though if you live outside of the US don't let that put you off. In doing some research, we found these incentives around the world:

- Australia: Currently, the Victorian Energy Upgrades company is offering similar incentives. Click here to see if they might be good for you.

- New Zealand: In our research, we couldn’t find any current tax credit incentives for this truly advanced county, but it didn’t surprise us to discover that they have had a plan in action around energy efficiency since 2017.

Currently, their focus is more on creating Net Zero Emissions (creating as much energy as they are using) in their country and is offering some seriously excellent ($5000 to $10,000!) tax credits! - France: As you would imagine, the desire to be on track for the Paris Climate Accord numbers is beyond important here. Significant financial incentives for 5+ years have made homes and businesses more energy efficient with grants, loans, and tax credits.

The French Government is also offering incentives on electric vehicles as they intend to stop the sale of gas-powered cars by 2040. - The Netherlands: The primary focus of this country is to change all business buildings into ‘energy neutral’ places that don’t use more energy than they create.

As per residential power, their goal is to have 100% of homes switch from fossil fuels to electric power by 2026. They are so serious about this that they have an Energy Investment Allowance that allows you to deduct up to 45.5% of the cost to decrease your energy usage at home and at work. - Germany: There’s no fooling around regarding lowering energy consumption in Deutschland. The government threw everything at it years ago with tax incentives and loan programs to:

- Modernize how buildings use energy

- Eliminating coal to heat or cool

- Adding more ecological industrial equipment

- Incentivizing electric vehicle purchases

How long will the Energy Appliance Tax Credit last?

The original Energy Star Tax Credits were supposed to be only until December 2022. Due to the Inflation Reduction Act of 2022 (signed in August 2022), these energy tax credits for homes & businesses now go through 2032!

That’s not a typo; I said 2032!

The US Government is serious about giving us all the ability, time, and financial resources we need to drastically shift our energy consumption.

What else can you do to help the energy crisis?

Are you’re interested in seeing what else you can do to make a difference in your personal energetic footprint?

Believe it or not there are more ways than you can count on both hand and we’ve gone deep into the rabbit hole on how to decrease your

energy usage while saving money to do it.

Click here to learn more about ways you can change your energy usage through other energy saving technologies, Alternative Energy Sources you can add to your home and ways you can do both of thes more affordably!

4 Other Ways Energy Star Saves You $

- Energy Bill Savings: The US Dept of Energy requires that models with the energy star logo use 20% less energy than those with out it. You’ll be happy to note that this is really the bare minimum and many companies have far exceeded this number to a 40-50% reduction in energy costs.

- Energy Company Rebates: When you purchase an energy Star rated refrigerator most energy companies across the US offer rebates. Check to see what kind of rebates your local energy company offers.

- New Features Equal More Savings: In buying an Energy Star refrigerator you’ll find that there are many new features made specifically to keep food fresher, longer than before.

- Save the Environment: Close to 70% of the electricity is made from coal and natural gas, which in turn causes a release of greenhouse gas. It’s these gases going into our atmosphere that help to cause the issues with global warming. When you purchase an Energy Star Refrigerator it uses less energy which in turn allows you to decrease your carbon footprint and your impact on our environment.

Other Energy Star Related Articles

If all of this Energy Star stuff is new to you, here's some other articles we've written on the topic to help you learn all that you need to know to be "Energy Star Educated".

Energy Star Refrigerator Reviews: We've included all of the models we've already reviewed that are Energy Star Rated so you can pick the best one for your neeeds.

Energy Efficient Refrigerators: Need tips to know which refrigerators really are energy efficient, take a look at the list we've compiled here.

Refrigerator Efficiency: Sure buying an Energy Star rated refrigerator is important but if you don't use it properly it doesn't make a difference. Learn how to make your refrigerator more efficient.

Energy Star Appliances: If you're looking for more items than just a refrigerator then why not look for an Energy Star appliance.

Energy Star Rebates: Starting August 15, 2009 each state will be offering rebates for any purchase of certain Energy Star Appliances. We've done some research so that you'll know how to access these appliance rebates.

Energy Star Tax Credit: To help sort out all of the confusion, here's an article on an Energy Star Tax Credit for certain improvements you've made on your home.

Energy Star Rating: What does Energy Star really mean and how do you read the ratings? We've covered all of this and more in this article.

Cash for Clunkers: A new $300 million program starting in the fall that can put up to $200 in your pocket towards a purchase of your new, energy efficient refrigerator.

Refrigerator Reviews

Energy Star Reviews

A Place Where Your Opinion Matters:

We Want Your Refrigerator Review!

If you want to see refrigerator reviews from others then scroll down to the bottom of the page but we need YOUR opinions and experiences, too! This way you can help and be helped.

- What brand (Amana, Whirlpool, etc.)and model number is your refrigerator?

- What style is it (e.g. french door, side by side, etc.)?

- How long have you had it?

- Why do you love or hate it?

- Was it reliable?

- Would you recommend it?

- Anything else YOU THINK we should know!

- And please SUBMIT PICTURES so that we can see what you LOVE or HATE about it!!

Tell us your whole story! We hear from people every day who want to know what you have to say. Your review could very well help someone else make the right decision!!

Recent Articles

-

Top 10 Refrigerators 2025 - Editor's Picks and Reviews

Jun 24, 25 03:58 AM

Discover the Top 10 Refrigerators 2025. Our editors rank the best models for every budget, kitchen size and style -- and help you find the best price. -

LG, Bottom Freezer, LDC22720ST

May 02, 24 01:00 AM

Bought an LG Bottom freezer refrigerator from a well known explanation point department store. And purchased the 10 year warranty for major components. -

Is it safe to set a full size refrigerator on carpet?

Jan 18, 24 05:18 PM

I have a full size refrigerator with top freezer. Is it safe to run it setting on a carpeted floor, if not what can I put under it? The unit is brand

New! Comments

Have something to say about what you just read? Leave a comment in the box below.